We all want to go on our dream vacation, but sometimes we need more money to cover the trip and other expenses. Here are 15 ways to save for your vacation.

15 Ways To Save For Your Vacation

One day, I spoke with my friend about my latest vacation, and he asked if we had the same income, how I could afford to go on vacation, and he couldn’t. I shared these 15 tips with my friend. Here are 15 ways to save for your vacation.

Set a Savings Goal

This is the first step to saving for your vacation, and you need to know how much you need to save. To find the estimated number, you can do the following.

Determine the destination and the cost

Where do you want to go for your dream vacation? How much will it cost to get there, and what is the accommodation cost? You can find this information online or on booking sites like Booking.com.

This is your savings goal—the money you must save to pay for this vacation. I would add 20% extra as an emergency, as the cost might change. It might go higher or lower. That 20% will be the safety net in case it goes higher.

Create a Budget

Now that you know how much it will cost you to go on the vacation, you need to create a budget.

The simplest way to achieve this is to divide the vacation’s total cost by the months remaining until your journey.

If you go on vacation in the next six months and the cost is $6000, the total will be $6000/6=1000. You need to create a budget and save $1000 per month.

You can go further and make it a weekly goal, divide $1000/4, and get $250.

Open a Dedicated Savings Account

I recommend opening a new account for your travel expenses, which should be separate from the one you use for your daily expenditures.

If you can get an account that will give you some yield, it is better to ensure the yield percentage is higher than the inflation rate in your country.

For example, I live in Mexico, and the inflation here is 4.4% when writing this. Any account that pays me more than 5% or higher on my savings is great.

The reason you want to do this is that the inflation % indicates how expensive things are becoming. $ 100 in six months will buy fewer things than today.

Automate Your Savings

We are human beings, and we are busy. After opening a new account for your vacations, I recommend automating your savings.

Most banks have this option, which allows you to program an automated withdrawal from your account. You can do this every day, every week, every two weeks, or every month.

Depending on your budget and savings frequency, you can set up a fixed amount of cash to be sent to your travel savings account.

Cut Unnecessary Expenses

One of the things I discussed with my friend was that I could save money to go on vacation to Istanbul by not buying expensive coffee.

You see, I work five days a week, and each day, I buy coffee for 100 Mexican pesos, which is 500 Mexican pesos per week.

If I go to the office 50 weeks per year (2 weeks for vacation), that is 25000 Mexican pesos.

When I stopped buying that coffee and started drinking the free one from the company’s cafeteria (lower quality), the money I saved was enough to pay for my plane ticket to Istanbul and some accommodation changes.

Find expensive things you spend money on, reduce the amount, or eliminate them, and save the money for your vacation.

This does not mean you need to be frugal, spend money on things you love, and cut it from unnecessary expenses.

Cook at Home

I like eating good food, and I go out every weekend, but if you are on a budget, you can reduce the amount you eat out and cook at home.

Cooking at home will help you save money on food and restaurant tips, including ordering food via apps.

Sell Unused Items

If you have items you no longer use, you can sell them. These can be your home accessories, electronics, or used shoes or clothes.

Declutter your home and sell items you no longer need. Use platforms like eBay, Craigslist, or local garage sales to turn unused items into cash.

Side Hustle or Freelance Work

I will be honest: I like expensive things, so cutting things out worked for a while, but I reached a point where I could not do it anymore.

In this case, I started freelance work designing websites for customers and making more cash this way.

Depending on your skill set, you can start a side hustle or a freelance job and make cash this way.

Use Cash Back and Rewards Programs

I use credit cards to pay for almost everything, and they are a great way to join travel rewards programs or earn travel miles.

However, if you do not like credit cards, you can earn cashback or travel miles without them.

Plan and Book in Advance

In my experience, buying travel tickets and hotel accommodations in advance will save you money.

I usually buy tickets for international travel three months before and for domestic travel three weeks before.

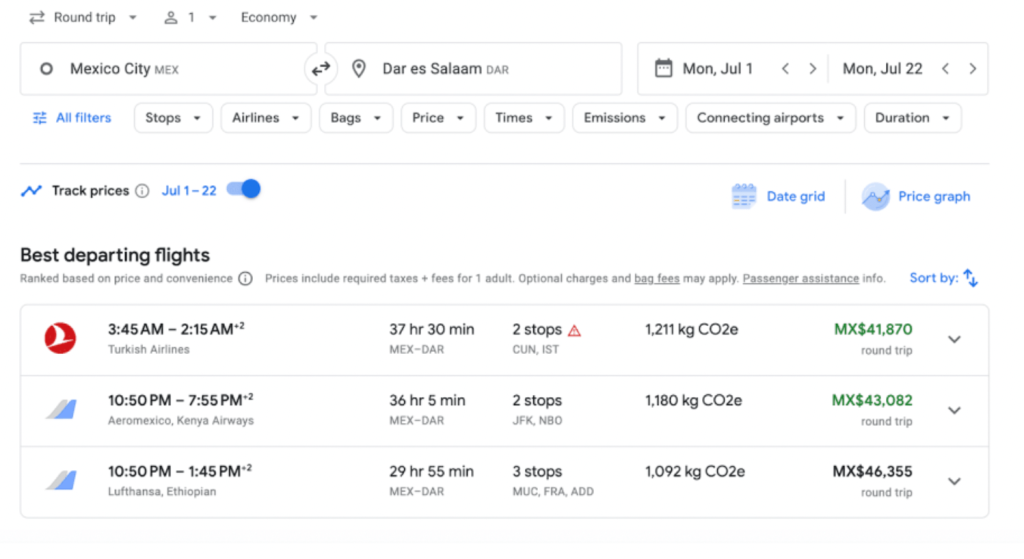

Another trick I use to get cheap tickets and save money is to set up a Google travel alert and select track prices.

Google will send me an alert every time the pricing changes. This way, I will know when to buy the ticket when the prices are lower.

Cut Back on Luxury Expenses

We all like to live a luxurious life; actually, it is my life philosophy to live a luxurious life as much as I can.

But sometimes, that is not possible. In that case, you will have to cut that, at least for a moment, until your income allows it, and save that money for travel.

Explore Travel Discounts

Airlines or travel agents offer many discounts throughout the year. Last year, I got a discount from KLM. The usual price from Mexico to Kilimanjaro via Amsterdam is about $3000, but I got a ticket for $1000 for the same route. All I did was Google it.

Also, some Airlines, banks, or travel agents offer discounts during certain events. For example, here in Mexico, the last week of May is Buen Fin, and most banks offer up to 30% off travel tickets and hotel accommodation, or if you purchase on booking sites using their credit cards.

Save Windfalls

If you have a corporate job like mine, sometimes you can receive a bonus, a Christmas bonus, win an award, or anything else. Whenever you get a sudden income, save it for your vacation ( at least a part of it).

Host a Fundraising Event

I have a friend who came here to study in Mexico. After more than eight years without going home (he is from Africa), he decided to host a fundraising event where he told guests that he wanted to go home to visit his family.

Still, the economy was not good; people could contribute to that event, and he got more money than he needed and went on vacation.

It is difficult for everyone to pull this up, but it can be done.

Track and Celebrate Milestones

I know this post is about saving money for a vacation, but I recommend celebrating when you reach a certain milestone, say ¼ of the budget, ½ of the budget, etc.

Celebrating your milestones will help you keep your motivation to save even more money ( so that you can celebrate again).

I do not know the real reason why this works, but it works: you can track your progress and celebrate each milestone.

QA: Ways To Save For Your Vacation

How much should be saved for a vacation?

Many people set aside 5-10% of their net yearly income for leisure travel, but this can vary greatly based on the type of vacations they plan.

What is a vacation savings account?

A vacation savings account is a travel fund that you create to help you save for future trips.

It’s separate from your regular savings account but could be linked to your checking account for easy transfers.

Can I get a loan to pay for my vacation?

I do not recommend getting a loan for a vacation; it is better to save money for it.

Can I pay for my vacation with a credit card?

Yes, you can pay for your vacation with a credit card, but I do not recommend paying with an installment plan ( with or without interest). Pay it in full.

Key takeaways: 15 Ways To Save For Your Vacation

Here are 15 Ways To Save For Your Vacation

- Create a Budget

- Set a Savings Goal

- Open a Dedicated Savings Account

- Automate Your Savings

- Cut Unnecessary Expenses

- Cook at Home

- Sell Unused Items

- Side Hustle or Freelance Work

- Use Cash Back and Rewards Programs

- Plan and Book in Advance

- Cut Back on Luxury Expenses

- Explore Travel Discounts

- Save Windfalls

- Host a Fundraising Event

- Track and Celebrate Milestone

Remember, consistency and conscious choices about your spending habits are important.

By implementing these strategies, you can build up your vacation fund and enjoy your getaway without financial stress.